Showing 18 results for:

mellody-hobson

Popular topics

All results

John W. Rogers Jr. had the confidence to make history at 24 years old because he was an investor at 12. As AFROTECH™ previously told you, it would be his father, who made the decision to ensure Rogers received stocks for Christmas and his birthday instead of toys, which included $200 worth of shares from companies such as General Motors and Commonwealth Edison. His father also played a role in him connecting with Chicago, IL’s first African American stock brocker, Stacy Adams, who became a mentor and role model. While both his parents worked as lawyers — his mother even made history as the first Black woman to graduate from the University of Chicago Law School — not to mention his grandfather, he never felt pressure to follow a similar footprint and was trusted to make his own decisions. Ariel Investments Rogers went on to pursue education at Princeton University, earning a degree in economics by 1980. He then spent two and a half years as a stock broker at William Blair and,...

After years of letting baristas bring their full selves to work — tattoos, flannels, colored hair, and all — Starbucks is reining things back in. Starting May 12, the coffee giant is introducing a new, streamlined look that puts the brand’s most iconic symbol — the green apron — back at center stage. The 2025 Starbucks dress code will require employees to wear solid black tops (collared, button-up, or crewneck) paired with bottoms in black, khaki, or blue denim. This shift is being framed as a branding move, part of Starbucks’ ongoing effort to create a familiar and consistent vibe in stores across North America. Each employee, known internally as a “partner,” will also receive two company-branded T-shirts at no cost, including options designed by partner networks. Why The 2025 Starbucks Dress Code Signals More Than Just A Wardrobe Change At first glance, it might look like a simple update to the dress code. But the new dress code is actually doing a lot of heavy lifting. It’s a...

John W. Rogers Jr. founded the nation’s first Black-owned mutual fund company and remains committed to expanding opportunities for other minority groups. Rogers comes from a family who upheld civil rights, fairness, and economic justice, he revealed in an interview with the SIU Paul Simon Public Policy Institute. It would be his father who sparked his interest in finance and economics. When Rogers was 12 years old, he received stocks as gifts for Christmas and his birthday. These included $200 worth of shares from companies such as General Motors and Commonwealth Edison, and he was able to pocket the dividends from those investments. “My dad was very insistent,” Rogers explained in the interview. “He wanted me to learn everything there is to know about the market, so he made me read the annual reports of the companies that were sent out every year, the quarterly reports that the companies would send out in those days, and I’d read about those companies.” His father also connected...

Seattle, WA-based Starbucks plans to lay off 1,100 corporate support employees as part of an effort to streamline operations and improve efficiency. On Monday, Feb. 24, 2025, Starbucks CEO Brian Niccol announced in a news release that those affected will receive notice on Feb. 25. The decision comes after senior leaders began “evaluating the role, structure, and size” of the coffee chain’s global corporate teams in January. “I recognize the news is difficult. It is not a decision the leadership team took lightly,” Niccol wrote. “We understand the real effect this has on partners’ lives and their families. We believe it’s a necessary change to position Starbucks for future success — and to ensure we deliver for our green apron partners and the customers they serve.” The release noted that the layoffs do not affect Starbucks retail store employees or baristas. While the plan also includes eliminating several hundred additional open and unfilled positions, Niccol said the company will...

Mellody Hobson is exiting her board role at Starbucks. Hobson is well regarded for her efforts at Ariel Investments, a global value-based asset management firm, where she is responsible for management, strategic planning, and growth beyond research and portfolio management as co-CEO and president, her LinkedIn mentions . In 2021, Hobson launched Ariel Alternatives, LLC, leading to a $1.45 billion raise for its private equity fund, Project Black. This initiative aims to support both non-minority-owned middle-market companies and those currently owned by Black and Latino entrepreneurs that generate $100 million to $1 billion in revenue, as AFROTECH™ previously reported. With funding, these companies would then be expected to transform into certified minority business enterprises of scale to serve as Tier 1 suppliers to the Fortune 500. Hobson has also been tied to various corporate boardrooms. She was a board member of the Estée Lauder Companies and chairman of the board of DreamWorks...

Rapper Nelly is doubling down on his decision to sell his catalog. As AFROTECH™ previously told you, the artist sold 50% of his catalog to HarbourView Equity Partners in 2023. The deal reportedly included singles such as “Ride Wit Me,” “Dilemma,” and “Hot in Herre” and was worth $50 million. On a recent episode of “The Shop” podcast, Nelly discussed his decision to sell a portion of his catalog, explaining that it was a move to secure his equity and build generational wealth. “You filtered both through both of those. You can never really sell anything like that forever. Technically a lease. So in like 30 years it comes back,” Nelly said on “The Shop.” “So, if I ain’t took the little 50 mil and made nothing happen in 30 years, then I need my a– whooped anyway. You hear a lot of people say, ‘I would never do it. I would never do it.’ Why wouldn’t you do it? That’s your equity, that’s your gold.” He continued, “That’s why you would never have generational wealth because what you don’t...

It was always bigger than football for Jaylon Smith. Raised in a town like Fort Wayne, IN, Smith connected with his purpose early on, describing himself as a natural-born visionary. By age 11, he developed aspirations of becoming an entrepreneur, following in the footsteps of his mother, who ran a daycare business for 13 years, he told AFROTECH™ in an interview. Yet, that was not his only early-seeded vision. He also hoped to play in the NFL when he was 7, but he knew his calling would extend beyond the field. “I never wanted to be remembered as just being a great athlete,” Smith told AFROTECH™. Sports agent Eugene Parker, who worked with football greats including Deion Sanders, guided Smith and taught him valuable lessons. The two connected through Smith’s grandmother, Parker’s aunt. “I had to take a lot of principles of what I learned from him and just from observing him,” Smith said. “He had a huge impact on a lot of Hall of Famers, a lot of the greats that played the game. So,...

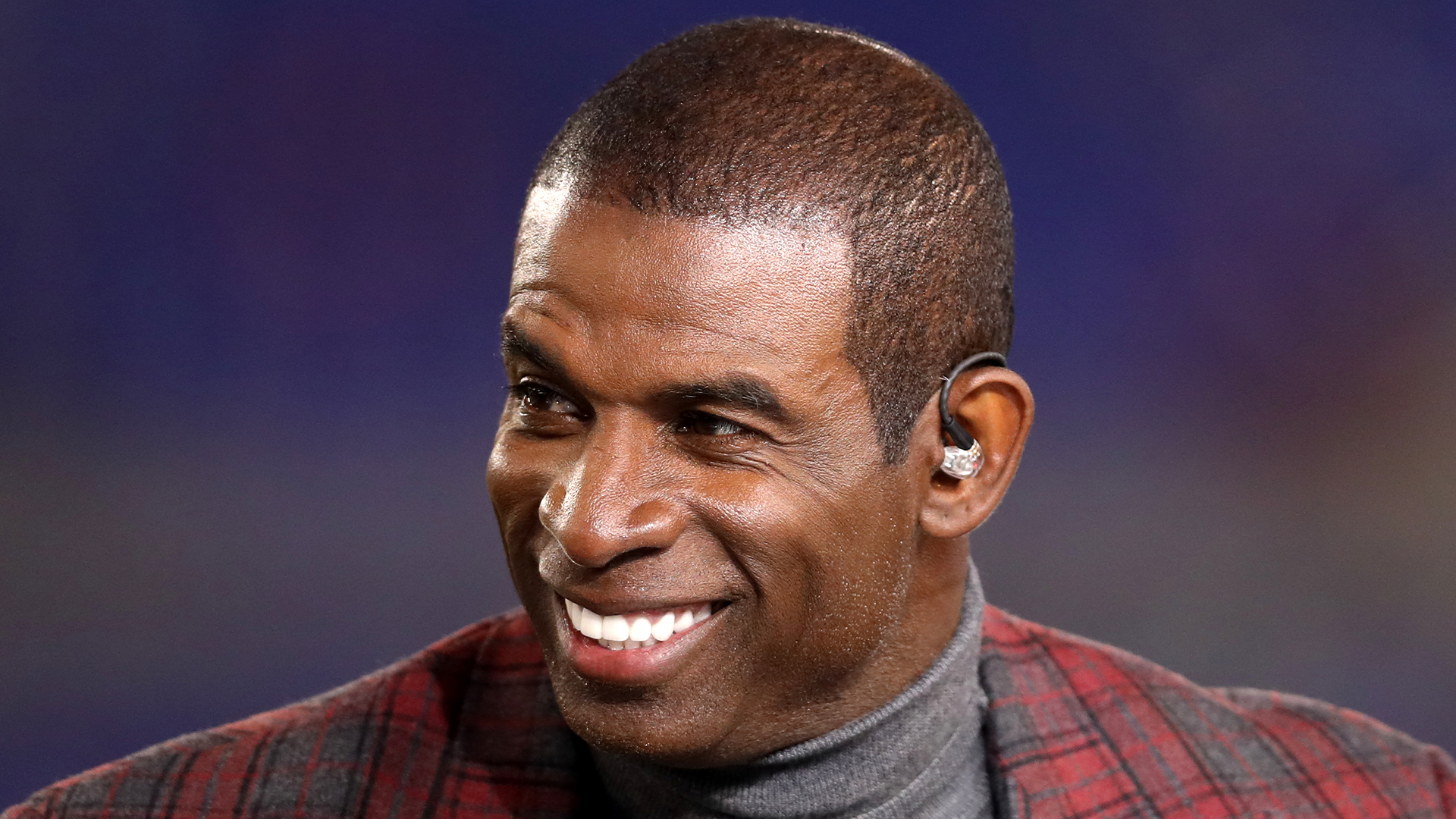

Second chances can apply to your personal life and business , which was the case for Deion Sanders and the footwear and apparel corporation Nike. In 1992, while playing in the National Football League (NFL), Sanders signed an endorsement deal with Nike, according to Sports Illustrated. It was reportedly worth $250,000 for the first six months, per Sportskeeda. However, Sanders was presented with another offer for significantly more money from the 1980s shoe brand British Knights. According to CantonRep, it was a $750,000 cash grab. “I almost did that, I was close,” Sanders said in a 2017 interview with Complex. Sanders also had the option to sign with LA Gear. Ultimately, Sanders settled with Nike in 1992, and his deal reportedly increased to seven figures within six months of the initial signing, Sportskeeda notes. “Nike came on with the bag, too,” Sanders told Complex. In 1993, Sanders was granted his own signature line, “The Nike Air Diamond Turf,” Sports Illustrated mentions....

Over the past four decades, Mellody Hobson has shattered glass ceilings. The businesswoman and investor joined Ariel Investments, the first Black-owned mutual fund company, as president for 20 years until she became co-CEO in 2019. Hobson has worked alongside John W. Rogers Jr. — who founded Ariel Investments at age 24 — for a long period. However, according to Fortune, the duo’s workplace camaraderie runs deeper than some may know. In February 2024, Ariel Investments announced the release of “Ariel at 40,” which was produced by Crystal McCrary McGuire Productions. The documentary tells the story of how the firm fought back against numerous challenges and persevered. View this post on Instagram A post shared by Ariel Investments (@arielinvestments) “I don’t come from the world of finance, but from a filmmaking perspective, it was just such an incredible story of perseverance, excellence, and trailblazing,” said McGuire, who described Ariel Investments to the outlet as an...

History has officially been made in the NFL! On July 7, Sandra Douglass Morgan was hired to be the president of the Las Vegas Raiders — making her the first Black woman president in NFL history.

For as long as the average American can remember, the words “coffee grower” immediately conjured up images of Juan Valdez and other South and Central American farmers. But, thanks to the pandemic, Black coffee growers are reclaiming their place in the global market. As with everything else in the world, the origins of actual coffee-growing trace back to Africa. According to the History of Coffee, the Moroccan mystic Ghothul Akbar Nooruddin Abu al-Hasan al-Shadhili first reported the growth and use of coffee while traveling in the Sheba Empire, which existed in 850 CE in what is now Ethiopia and Yemen. (Kaffa, a town in modern-day Ethiopia, literally means “coffee.”) But thanks to Dutch colonialism in Africa, coffee seeds were stolen and brought to the West Indies in the 1600s — and with the seeds came the slaves, who went from Black coffee growers to plantation workers. Today, the international coffee industry is a $225 billion operation, yet “less than 10% of that aggregate wealth...

John W. Rogers Jr. made headlines when he formed Ariel Investments back in the 1980s. The company is a Black-owned mutual fund giant that is one of the first — and only — of its kind. Now, he’s making headlines again. Forbes is reporting that the firm launched a private fund business called Ariel Alternatives, with the backing of a to invest and scale sustainable minority-owned businesses. The endeavor is called “Project Black,” and it will be co-chaired by Ariel Investments co-CEO Mellody Hobson and Leslie A. Brun, the founder and former head of Hamilton Lane, a powerhouse alternative investment firm with $500 billion in assets. The fund was formed with the intent to close the racial inequality gap. “Through Project Black, we plan to ultimately disperse opportunity throughout underrepresented communities. We want to change the narrative and foster true action and demonstrable change,” said Hobson. “While we have been encouraged and inspired by the supply chain diversity commitments...