Showing 156 results for:

Black investors

Popular topics

All results

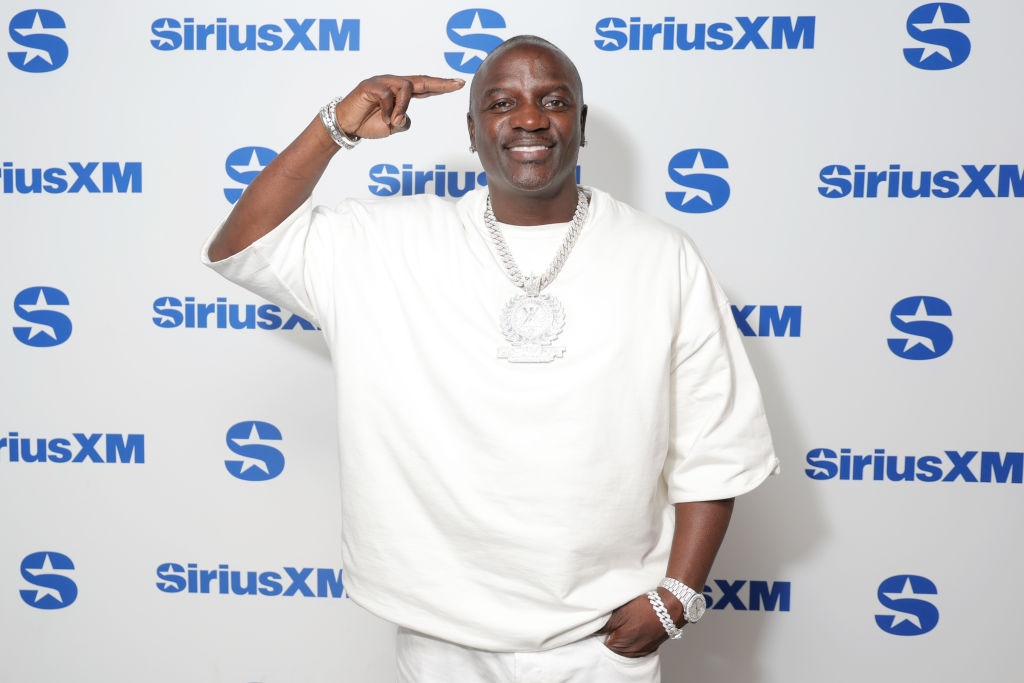

Akon’s $6 billion plan for a real-life Wakanda on Senegal’s Atlantic Coast “no longer exists,” said Serigne Mamadou Mboup, head of Sapco-Senegal, the state agency overseeing coastal and tourism development. The country has reclaimed most of the land allocated for “Akon City” after the Senegalese-American singer missed payments, according to Bloomberg. As Senegal faces a debt crisis following a state audit under former President Macky Sall, the government will move forward with a scaled-down, privately funded $1.2 billion tourism development featuring hotels, apartments, a marina, and a promenade, the outlet reported. “May this resort serve as a model for success in Senegal, a hub for tourism and a source of economic opportunity,” Mayor Alpha Samb said at a ceremony, according to Bloomberg. In 2020, Senegal granted Akon 136 acres of land for a 10-year project to transform the farming village of Mbodiène into a solar-powered city that would run on the singer’s cryptocurrency and...

Salt Lake City, UT-based Holladay Bank & Trust — located in a community with a Black population of less than 3% — is now Redemption Bank, following its acquisition by Redemption Holding Co. (RHC). Initially announced in 2023, the deal marks the first time a Black-led investment group has owned a bank in the Western U.S., according to The Associated Press. Redemption Holding Co. Chairman and CEO Ashley D. Bell, former White House policy advisor, cited the collapse of Silicon Valley Bank in 2023 for the acquisition delay. “This process has undoubtedly taken longer than any of us anticipated,” Bell said. “However, we are grateful for the diligence of the staff at the FDIC, the leadership of the (American Bankers Association), and the renewed sense of urgency from the new administration this year, all of which helped bring everything together.” Redemption Bank is now the first Black-owned bank in U.S. history in the Rocky Mountain region and the only one in the “Black-banking desert,”...

We are shedding a light on a group of Black pioneers making significant strides. AFROTECH™ Future 50 Launched in 2022, the AFROTECH™ Future 50 is a prestigious list that amplifies 50 innovators, visionaries, founders, venture capitalists, technologists, and changemakers annually. Dynamic Investors – venture capitalists empowering underserved founders in tech. Future Makers – recognizes professionals for groundbreaking innovation and historical firsts in technology. Visionary Founders – acknowledges the accomplishments of founders who showcase outstanding company growth and a strong dedication toward promoting diversity and inclusion. Changemakers – honors individuals for significant social impact in the tech industry. Corporate Catalysts – professionals who have a track record of championing diversity. Legacy Leaders View this post on Instagram A post shared by AFROTECH (@afro.tech) Exemplifying the aforementioned categories are our Legacy leaders who have upheld these standards of...

In East Oakland, CA, a powerful coalition of Black-led organizations has secured $100 million to fund Rise East, a decade-long effort to transform 40 blocks into a model for what real community-led development can look like, Shoppe Black reports. According to the outlet, after decades of disinvestment and promises not met, the project marks one of the most significant grassroots investments in Oakland’s history, aimed at reversing long-standing patterns of displacement and economic exclusion. A Vision Rooted In Community At the center of Rise East is the 40×40 Council, a group of Black-led nonprofits working together to create long-term stability by focusing on three key areas: education, public safety, and housing. The 40-block area, according to Shoppe Black, spans from Interstate 580 to the San Francisco Bay and from Seminary Avenue to the San Leandro border. It’s home to Oakland’s largest concentration of Black residents, a community that has long endured the ongoing effects of...

Collab Capital, which backs early-stage founders, has closed its second fund. Collab Capital’s Mission The venture capital firm was co-founded in 2019 by Jewel Burks Solomon, the former head of Google for Startups in the U.S., to advance innovation across work, health care, and infrastructure and invest in financial, human, and network capital, its LinkedIn mentions. The firm had previously raised $50 million in its first fund, which has enabled investments in 38 early-stage startups, including Goodr, a food waste startup that is launching a “first-of-its-kind” community space in Atlanta, GA. The new Goodr Community Market at Edgewood will allow 200 families to shop for free and will give $5 deli meals to kids that visit the space with books, the company noted on LinkedIn. Everything in the market is also SNAP-eligible. $75M Raise Collab Capital wants to further its investments in founders addressing “big, systemic problems,” according to TechCrunch. It has now closed its second...

TIAA President and CEO Thasunda Brown Duckett is now an investor in the WNBA’s New York Liberty. As AFROTECH™ previously told you, Duckett is one of two Black women CEOs of Fortune 500 companies. Now, she is making headlines for her minority stake in the New York Liberty as part of an investor group, Essence reports. Majority team owners, Clara Wu Tsai and her husband, Joe Tsai, raised capital through the group at a valuation of $450 million, which is a record for a professional women’s sports franchise, according to The New York Times. What’s more, Clara shared that she thinks the team is capable of becoming the “first billion -dollar women’s sports franchise.” The Tsais are also co-owners of the NBA’s Brooklyn Nets. Duckett expressed on Instagram, “Sports has made a profound impact in my life. It taught me grit, perseverance, teamwork and resilience. To be an investor in women’s sports and the NY Liberty franchise is truly an impact moment.” View this post on Instagram A post...

Byron Allen is selling local television stations owned by his Allen Media Group (AMG), with investment bank Moelis & Co. handling the deal. The portfolio consists of 28 stations affiliated with ABC, NBC, CBS, and Fox, operating in 21 U.S. markets, including Tupelo, MS ; Honolulu, HI; Flint, MI; and Tucson, AZ, according to The Hollywood Reporter. Allen said AMG began investing over $1 billion six years ago to build a portfolio of “big four” network-affiliated television stations. “We have received numerous inquiries and written offers for most of our television stations and now is the time to explore getting a return on this phenomenal investment,” Allen said, per THR. “We are going to use this opportunity to take a serious look at the offers, and the sale proceeds will be used to significantly reduce our debt.” As the media landscape continues to evolve, AMG has been navigating industry challenges and, over the past year, has implemented a series of measures to streamline...

Martha’s Vineyard is a place of solitude for Black families during the summer. The island in Dukes County, MA, was recently featured in the popular Netflix series “Forever” directed by the legendary creator of “Girlfriends,” Mara Brock Akil. In the new show, characters Keisha Clark (played by Lovie Simone) and Justin Edwards (played by Michael Cooper Jr.) reconnect in Martha’s Vineyard after a breakup. Edwards’ family resides particularly in Oak Buff each summer. History Of Martha’s Vineyard Explained Furthermore, the location of their reconnection was intentional, per Brock Akil, who lives part-time in Martha’s Vineyard, according to Netflix. The series is adapted from Judy Blume’s 1975 YA novel of the same name, and Episode 5 takes viewers to Martha’s Vineyard, serving as a love letter to the island. “Understanding the essence of the island, even in the way it shaped the story, is important,” Brock Akil told Netflix. “You think you’re just arriving on the island, and you don’t...

South Loop Ventures has officially closed a $21 million Fund I to support early-stage startups, with a strong focus on founders of color, TechCrunch reports. The Houston,TX-based venture firm is part of a growing movement to reshape who gets access to capital and where that capital flows. Fueling Founders From The Ground Up Founded in 2022 by Zach Ellis, South Loop Ventures, according to TechCrunch, focuses on seed and pre-seed investments, writing average checks of about $400,000. Anchor investors include Rice Management Co. and Chevron Technology Ventures. Additional contributions came from Texas Capital Bank and The Great Commission Foundation of the Episcopal Diocese of Texas. The tech outlet reports that the firm has made 13 investments and plans to back at least 30 companies from the fund. “We thought it was important to have a fund focused on diverse founders here in Houston, given Houston’s diversity,” Ellis told the outlet. Though South Loop Ventures invests nationally, its...

The spirit of Robert F. Smith inspired the launch of a multi-million-dollar hospitality fund. As AFROTECH™ previously told you, Smith is the founder of Vista Equity Partners, which invests in technology companies and fulfilled its largest raise to date in 2024, amounting to $20 billion to lay the groundwork for its focus on artificial intelligence (AI). Smith’s strategy has served as a blueprint for innovation in the hospitality sector. According to information shared on LinkedIn, Will Huston — founder and chief investment officer of Bay Street Hospitality — shares a similar interest in leveraging technology, but with a focus on uncovering overlooked investment opportunities. The group is backed by a $430 million investment fund, according to Shoppe Black. “We’ve meticulously developed a quantamental model that provides strategic foresight, enabling us to pinpoint high-potential investments in markets where wealth inequality (distinct from income inequality) presents both a social...

Aruwa Capital Management, one of Africa’s few woman-led private equity firms, has secured $35 million for its second fund to invest in inclusive, impact-driven businesses across Nigeria and Ghana, according to a press release. Aruwa Capital Fund II drew backing from major institutions, including the Mastercard Foundation Africa Growth Fund (MFAGF), Visa Foundation, British International Investment (BII), and Nigeria’s Bank of Industry (BOI), the fund’s first local institutional investor, based on the release. It also attracted capital from global family offices and others with a target of $40 million. However, that number has since changed to $50 million, with a hard cap of $60 million. “In the midst of the current challenging fundraising environment, we are excited to have raised 90% of our target fund size for Fund II and to be upsizing due to strong investor interest,” said Adesuwa Okunbo Rhodes, founder and managing partner of Aruwa Capital Management, in a press release via her...

There are clubs that no amount of charm or charisma can get you into. The kind where wealth isn’t enough if it isn’t old, where opportunity depends not on merit but on access, and where the real decisions are made behind velvet ropes and closed boardroom doors. For far too long, the world of professional sports ownership has been one of those clubs. This is where Jaia Thomas and Diverse Representation enter the chat. What started as a digital directory for Black agents and publicists has evolved into a movement to radically shift the face of power in sports and entertainment. Through events like the recent Black Ownership in Sports Symposium in Atlanta, GA, Founder and CEO Thomas is not just asking for a seat at the table. She’s building new tables altogether. The symposium brings together current and aspiring Black owners, investors, and leaders to discuss tangible pathways into one of the most exclusive spaces in business. Paxton Baker was one of the speakers at this year’s...

John W. Rogers Jr. had the confidence to make history at 24 years old because he was an investor at 12. As AFROTECH™ previously told you, it would be his father, who made the decision to ensure Rogers received stocks for Christmas and his birthday instead of toys, which included $200 worth of shares from companies such as General Motors and Commonwealth Edison. His father also played a role in him connecting with Chicago, IL’s first African American stock brocker, Stacy Adams, who became a mentor and role model. While both his parents worked as lawyers — his mother even made history as the first Black woman to graduate from the University of Chicago Law School — not to mention his grandfather, he never felt pressure to follow a similar footprint and was trusted to make his own decisions. Ariel Investments Rogers went on to pursue education at Princeton University, earning a degree in economics by 1980. He then spent two and a half years as a stock broker at William Blair and,...

Symphonic Capital has launched its inaugural fund targeting overlooked founders in fintech and health care. Symphonic Capital’s Inception Sydney Thomas, who always displayed an “entrepreneurial spirit,” founded the venture capital (VC) firm in 2022. Having already dedicated years to being a serial investor, her work in venture capital began in 2016. It was during that time that she observed a common pattern: Many firms placed broad bets on numerous founders, accepting that most would fail in hopes that a few would yield outsized returns. However, she believed it was possible to have a more refined approach that would put more early-staged founders in a better position. “While it is still incredibly risky to work in early stage, a way to actually de-risk your investment is to have a much more structured and focused support strategy with those companies that increases the likelihood that they graduate from pre-seed to seed, and increases the likelihood that they graduate from seed to...

We are giving our flowers to Black leaders who are shaping the future. Established in 2022, the AFROTECH™ Future 50 list will commemorate innovators, visionaries, founders, venture capitalists, technologists, and changemakers in the technology sector who have made historic strides, lifted as they climbed to create a more inclusive future, and are transforming their sectors and communities. AFROTECH™ Future 50 Categories There are five categories for submission. The Dynamic Investors category highlights venture capitalists who have not only driven strong returns but have also championed underrepresented founders in technology. A prime example is Charles Hudson, founder and managing partner of Precursor Ventures, which manages over $175 million in assets and has made more than 413 investments, according to Carta. Next, the Future Makers category will honor Black professionals who have achieved historic firsts, earned industry recognition, launched groundbreaking products, measured...