Showing 52 results for:

African startups

Popular topics

All results

New funding has been raised to improve intercity travel across Africa. BuuPass Founded in 2017, BuuPass markets itself as a digital ticketing platform for bus, train, and flight purchases, its website mentions. Its inception was sparked during the 2016 Hult Prize Challenge, a global student competition that asked students that year to create something that would “better connect people to goods, services, and resources.” For company co-founders Sonia Kabra and Wyclife Omondi, this equated to making transportation more efficient in Kenya. “We’re building the infrastructure that makes modern travel work across Africa. Every new route, every operator, every integration strengthens the network,” said Sonia Kabra, co-CEO of BuuPass, according to Techcabal. The platform requires four simple steps for users, such as entering their travel dates, after which they will be shown various travel routes and pricing, per its website. Once the user selects an ideal route, they can book directly on...

A woman-owned trading finance platform is now positioned to scale its footprint in Africa. Liquify Established in 2023 by Nadya Yaremenko and Alberta Asafo-Asamoah, the Ghanaian company is the “f irst fully digital trade finance platform on the continent,” its website mentions. It exists to connect small and medium-sized enterprises in Africa with capital markets across the globe. The Condia reports that the platform allows exporters to turn unpaid invoices into cash in the same day while investors can tap into a high-yielding asset class with the added perks of short maturities and low market correlation. What’s more, Liquify has integrated AI into its due diligence process to create more competitive rates for exporters selling to investment-grade buyers along with lower operational costs. “We built Liquify to unlock the $120 billion trade-finance gap holding back Africa’s most dynamic SMEs,” Yaremenko (CEO) said, according to The Condia. $1.5M Raise Liquify has already financed $4...

This self-taught programmer has secured funding for his newly established startup. According to TechCrunch, Bereket Engida had an idea while living in Ethiopia to create a startup that would resolve issues he experienced around authentication. As a programmer, he created a platform that helped developers observe user behavior on their websites while he was working at remote software jobs. This took him down a new rabbit hole after he noticed frequent issues around authentication. He also did not have great faith in some of the tools that already existed to handle the process, which prompted him to take matters into his own hands. “I remember needing an organization feature. It’s a very common use case for most SaaS applications, but it wasn’t available from these providers,” Engida told TechCrunch. “So I had to build it from scratch. It took me about two weeks, and I remember thinking, ‘This is crazy; there has to be a better way to solve this.’” Better Auth This idea eventually...

A new round of funding has been raised to invest in the health of African businesses. PaidHR In 2020, CEO Seye Bandele and Chief Technology Officer Lekan Omotosho co-founded an HR management platform designed to support African businesses and their workers. According to a news release, the platform, named PaidHR, automates local and cross-border payroll in 49 currencies and has tools such as Earned Wage Access, which allows employees to receive a portion of their payment before payday. PaidHR can calculate taxes and pensions as well as file with the appropriate government agency. Additionally, it can set up benefits for medical insurance, pensions, housing, and more, its website states. “We’ve always been driven by a simple yet powerful idea: that managing your team and payroll shouldn’t be a source of stress, but a catalyst for growth and well-being,” the company stated in the news release. $1.8M Raise Led By Accion Venture Lab PaidHr, which launched in Nigeria, has expanded its...

Nigerian clean energy startup Salpha Energy has secured $1.3 million in funding from All On, an impact investment firm supported by Shell, People of Color in Tech (POCIT) reports. The funding will help Salpha Energy advance its mission of delivering dependable and affordable solar power to underserved communities across Africa. Notably, Salpha Energy is the only female-founded company in sub-Saharan Africa operating a solar home system assembly facility. Investment To Fuel Solar Growth And Innovation The $1.3 million investment will scale Salpha Energy’s operations, expand its product offerings, and strengthen its local assembly infrastructure. The company’s solar power solutions in Africa, ranging from 150Wp to 100kWp systems with battery storage and smart inverters, have already reached more than 2 million people, helping to make clean energy more accessible and affordable, according to POCIT. “This capital raise is a huge step forward in our vision to power homes and businesses...

One of Africa’s most prominent tech founders is stepping back into the spotlight with a new artificial intelligence (AI) venture. Karim Jouini and Jihed Othmani, his co-founder of Tunisian fintech startup Expensya, have launched Thunder Code, a generative AI-powered software testing platform. TechCrunch reports that the France- and Tunisia-based startup has already raised $9 million in seed funding. The return to startup life comes nearly two years after the duo sold Expensya to Swedish software firm Medius in 2023, according to the outlet. Although the terms of the deal weren’t disclosed, sources familiar with the matter told TechCrunch that they estimated it to be more than $120 million, marking one of the biggest African tech exits to date. From Promising Exit To New Beginnings Following the acquisition, Jouini assumed the role of chief product and technology officer at Medius. Neither he nor Othmani intended to return to entrepreneurship. However, Jouini’s exposure to the...

Carrot Credit, a Nigerian fintech company, recently announced via LinkedIn that it has raised $4.2 million in seed funding to expand its lending platform, which enables users to borrow against digital investment assets. The funding round was led by MaC Venture Capital, a firm that’s known for investing in diverse founders, as AFROTECH™ previously reported, with additional participation from Partech Africa and Authentic Ventures. When making the announcement, Carrot Credit stated that the funding will be used to support the company’s efforts to grow its team, enhance its credit infrastructure, and strengthen integration with digital investment platforms across Africa. Borrowing Without Selling: A New Credit Framework According to its website, Carrot Credit offers a unique approach to lending by allowing individuals to use their financial assets, such as stocks, exchange-traded funds (ETFs), government bonds, or cryptocurrencies, as collateral. Users can access up to 40% of the value...

Kofa , a Ghana-based energy tech startup, secured $8.1 million in a pre-Series A funding round to expand its AI-powered battery-swapping network across Africa, as Techpoint Africa reports. According to the outlet, the investment consists of $3.25 million in equity, $4.32 million in debt, and $590,000 in grants, and was co-led by E3 Capital and Injaro Investment Advisors. Additional contributions came from the Shell Foundation and the UK Government’s Transforming Energy Access (TEA) platform, as well as Penso Power’s CEO Richard Thwaites, among others. “This funding validates our vision to transform urban Africa’s energy landscape, and we are committed to building the ecosystem necessary to make this a reality,” Erik Nygard, Kofa’s founder and CEO, said in a press release. “The shift to cleaner energy, for both domestic and commercial use, goes beyond sustainability — it drives real economic impact, but for this transition to succeed, several key elements must come together.” Nygard...

Seven African healthtech startups have been selected for the latest cohort of the Investing in Innovation Africa (i3) program . Each will receive up to $225,000 in grant funding and tailored support to scale solutions that improve medicine access. Backed by the Gates Foundation, Merck & Co. Inc. (MSD), Sanofi, and others, i3 supports growth-stage startups working to close critical health care gaps. This cohort emphasizes pharmacy-related solutions, a vital part of health care in many African countries , where pharmacies handle up to 70% of initial patient visits, according to Urban Geekz. The selected startups, which are dedicated to developing a range of scalable, tech-enabled solutions, include: mPharma Chefaa Dawa Mkononi Meditect myDawa RxAll Sproxil Their offerings include AI-powered prescription refills, last-mile medicine delivery, cloud-based pharmacy systems, embedded financing, inventory management, and product authentication to reduce fraud and improve drug safety. “It is...

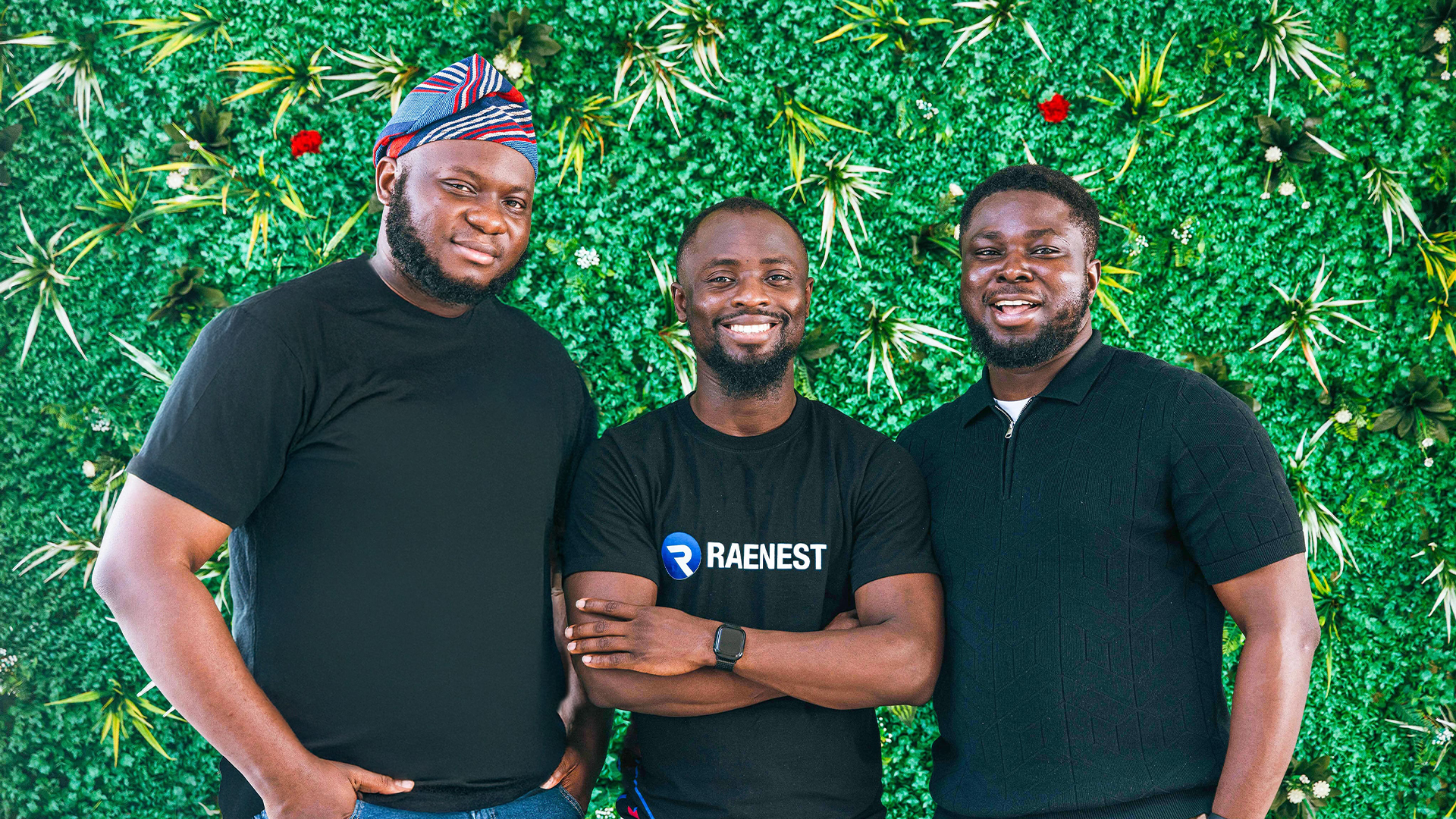

Fintech platform Raenest has raised new funding to support African businesses. The company, founded in 2022 by Victor Alade, Sodruldeen Mustapha, and Richard Oyome, offers a range of services, including virtual and physical dollar cards, international transfers, invoicing for global payments, the ability to create USD, GBP, and EUR bank accounts, and currency conversion, among other features listed on its website. Raenest’s original platform was structured as an Employer of Record (EOR), helping foreign companies pay employees on the continent while remaining compliant, TechCrunch reports. The founders recognized a deeper-rooted issue, leading them to update Raenest to assist the continent’s gig economy and businesses directly. “A U.S. company might not care if a payment is delayed by five days, but for someone in Nigeria or Kenya, that’s a big deal — especially when converting to local currency becomes another hurdle,” Alade told TechCrunch. Looking ahead, Raenest intends to secure...

Socium has raised new funding to expand its reach within Francophone Africa. The company, founded by Samba Lo (CEO) and Serigne Seye (chief operating officer), began as a recruitment website before scaling to offer HR solutions for businesses, notes TechCrunch. Per its LinkedIn, company offerings include: Payroll management Workflow management Performance evaluation Document management “Our customers started to ask us if we had solutions for payroll, time management, and performance management. So, we decided to build a global HR platform to help HR teams manage all their processes,” Lo told TechCrunch. Thanks to Socium, more Africa-based companies can now launch their businesses within a matter of weeks in the French-speaking countries. The company also leverages artificial intelligence to vet CVs and create job descriptions, TechCrunch notes. “Focus on people means focus on performance, their evaluation and competence, and career path for each individual,” Lo added. “And for this...

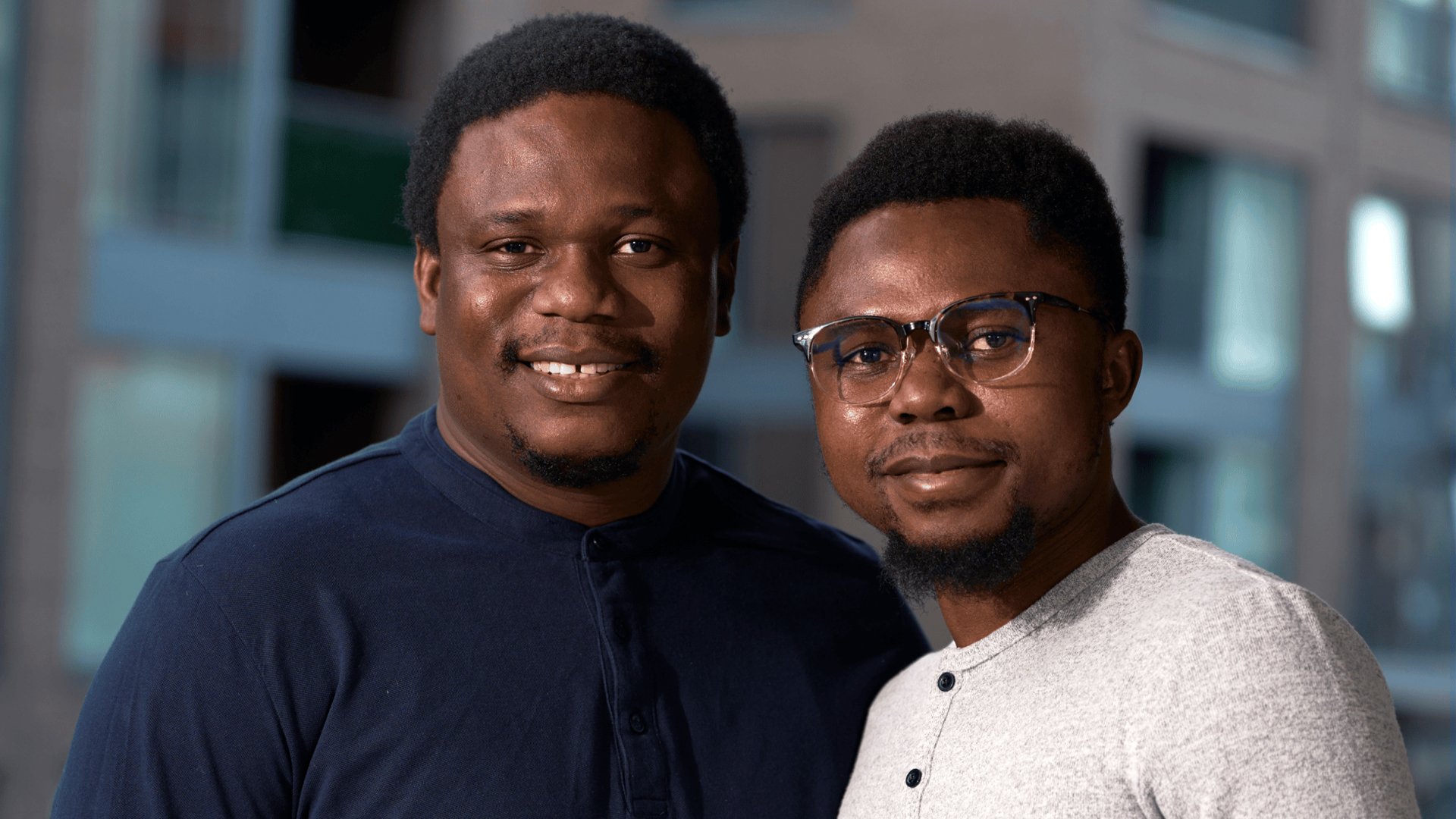

Tosin Eniolorunda and Felix Ike are reportedly behind Africa’s fastest-growing fintech company. According to a press release shared with AFROTECH™, the founders lead Moniepoint, which initially launched under the name TeamApt in 2015. The company has since become a trusted provider of financial solutions, reaching millions of entrepreneurs across Africa and processing over 800 million transactions a month, with those having a monthly total value of more than $17 billion. Moniepoint offers a free personal banking app that allows customers to benefit from a “debit card that always works,” Eniolorunda said in a YouTube video. In addition to banking accounts, the company offers loans, expense cards, instant payouts, and accounting and bookkeeping solutions, its website lists. Photo Credit: Moniepoint Moniepoint’s business model has made it Africa’s fastest-growing fintech in both 2023 and 2024, per the press release. It is now poised for further growth following a $110 million equity...

Waza has raised $8 million to improve the financial technology sector in Africa. TechCrunch mentions that emerging economies tend to buy more from other countries than they sell, leading to an increase in demand for U.S. dollars to trade internationally. Combined with limited supply, trading can be more expensive. The outlet also notes that Africa’s lack of technological solutions worsens the issue. Thus, Waza’s efforts are timely for Africa because it exists to ensure Africa-based companies and traders can have liquidity and more seamless B2B payments using U.S. dollars, euros, and Great Britain pounds, per the company website. Within its first month of operations, the company’s payment volume reached $280,000, according to TechCrunch. In May 2024, those numbers had dramatically increased, with $70 million in monthly payment volume equating to $700 million in annualized transaction volume, Co-Founder and CEO Maxwell Obi confirmed to TechCrunch. “Cross-border payments in the context...

Ethiopian sustainable tech startup Kubik has scored a first for the country. According to a press release sent to AFROTECH™, it has raised $5.2 million in a seed round. Investors include East African venture capital firm African Renaissance Partners, Endgame Capital, and King Philanthropies. It will now further its work in using plastic waste to make affordable buildings and removing waste from the environment. “Kubik’s vision to build safe and affordable living for all speaks directly to King Philanthropies’ mission to catalyze solutions at the intersection of climate and livelihoods,” Kartick Kumar, managing director at King Philanthropies, said in a press release. “Kubik is at the forefront of innovation in Ethiopia and across the African market, and we’re proud to support the tremendous impact they’re making combatting plastic waste and providing safe, durable, and affordable housing.” The funding round makes Kubik the first Ethiopian country to earn a multi-million-dollar...

Canza Finance’s co-founders are leaning into Web3 to financially empower the African continent. Pascal Ntsama IV and Oyedeji Oluwoye are looking to create “the world’s largest non-institutional-based financial system” through the creation of Canza Finance, the company website mentions. They both share distinct journeys on how they arrived to the company’s inception. For Chief Technology Officer Oluwoye — born in Nigeria, Africa, and raised in Sydney, Australia, before moving to the United States at 14 — he began taking various CompTIA Certifications, early-career data analytics certification, during his senior year of high school. After graduation, he headed to the Alabama Agricultural and Mechanical University to obtain a Bachelor of Science degree in computer science. While in college, he was able to secure a position with Adtran, a networking and telecommunications company based in the U.S., as a co-op engineer. He then transitioned to work at AT&T as a senior specialist-network...